Reduces Capex to $198 Million; Pre-Tax Internal Rate of Return (IRR) of 25.2%;

Average Annual Zinc Production of 46.9 Million lbs; Bottom Quartile Zinc Cash Costs

TORONTO, ONTARIO October 20, 2021 – Chieftain Metals Corp. (“Chieftain Metals”or the “Company”) (TSX: CFB) is pleased to announce the results of an independent, technical report (the “2014 Feasibility Update”) updating the Company’s 2012 feasibility study, prepared in accordance with NI 43-101, on the high-grade Tulsequah Chief polymetallic deposit located in north-western British Columbia as well as the nearby Big Bull deposit collectively referred to as Tulsequah Shazah Camp.

The 2014 Feasibility Update, prepared by a team led by JDS Energy & Mining Inc. (“JDS”), incorporates improvements to the Tulsequah Chief project including optimizing production configuration, operations, logistics and mill size, dramatically improving the financeability of the project. The 2014 Feasibility Update reflects a project with lower capital costs resulting in enhanced projected investment returns notwithstanding the lower annual production. Additionally, this operating profile preserves all the growth potential and is expected to allow Chieftain to flow funds for project expansion out of cash flow.

(all amounts in Canadian dollars unless stated otherwise)

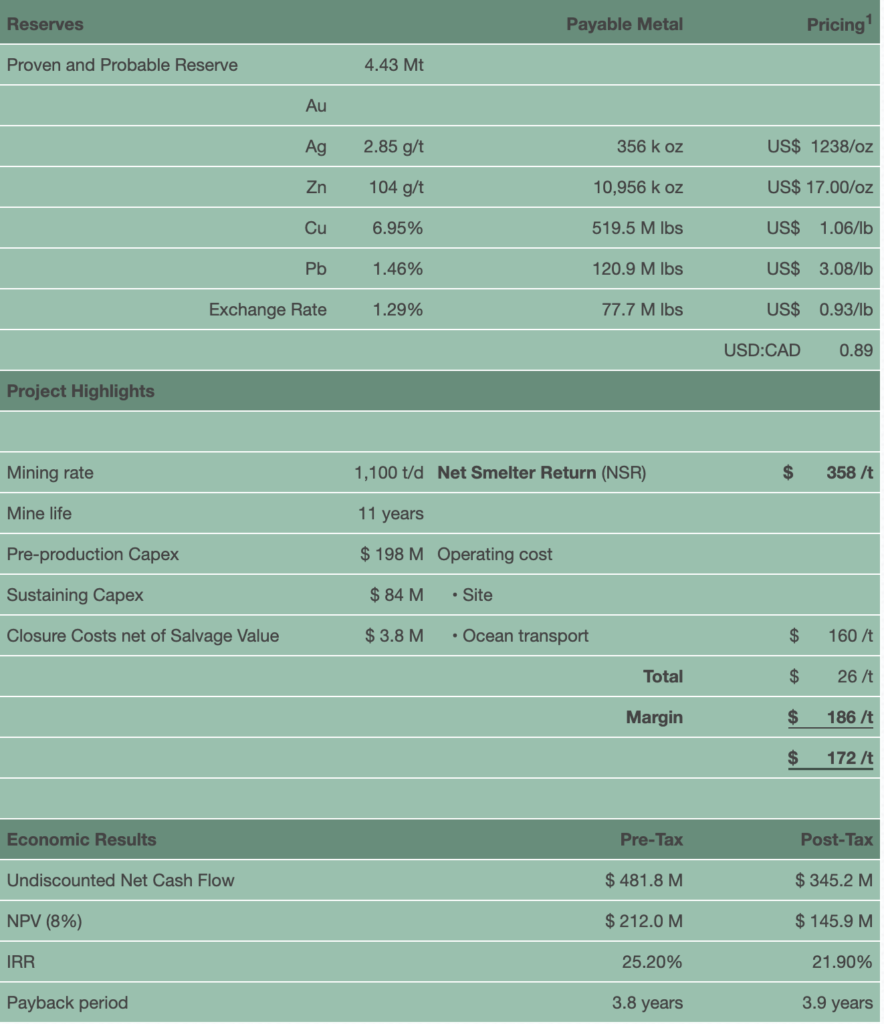

Highlights of the 2014 Tulsequah Chief Feasibility Update (Table 1)

- Based on a 1,100 tonne per day underground mining operation with an 11-year mine life.

- Reserves of 4.4 M tonnes (of which 684 Ktonnes (15%) are proven) are the higher-grade portion of the 6.4 M tonnes previously reported in the 2012 Feasibility Study.

- Base Case metal price deck for metals and foreign exchange based on spot prices at October 15, 2014.

- Annual Zinc Production of 46.9 million pounds (lbs) at a C1 cash cost of zinc production (net of by-product credits) of negative ($0.25)/lb.*

- Use of conventional barging for five months of the year to transport concentrate and supplies. This logistical solution eliminates the road proposed in the 2012 Feasibility Study saving $125 million in capex.

- Pre-production capital costs are estimated to total $198 million including contingency.

- Operating costs are estimated to average $186 /tonne processed including concentrate shipment.

- The Feasibility Update yields a pre-tax Net Present Value (NPV8%) of $212 million and an IRR of 25.2% and post-tax NPV8% of $146 million and an IRR of 21.9%.

* C1 Cash cost of zinc production is calculated by taking the life of mine operating costs and the off-site costs to produce all metals, minus the revenue generated by all produced metals excluding zinc, divided by the total pounds of zinc produced.

Victor Wyprysky, President and CEO commented: “We are pleased to deliver a feasibility optimization demonstrating strong economics for Tulsequah. The NPV8% of $212 million represents a pre-tax Net Asset Value of approximately $12.65 per share pre-financing based on the current outstanding shares and average annual EBITDA at full production of $69 million or $4.09 per share pre-financing based on the current outstanding shares. The lower tonnage design enables a much lower capex than first envisioned in 2012 without a significant decrease in operating cash flow due to the high-grade focus of the new mine plan. Given the market’s current preference for smaller capital projects, this feasibility update is expected to allow Chieftain to finalize project financing and plan construction start-up.”

Table 1. Highlights of the Tulsequah Chief Feasibility Update

1Spot prices October 15, 2014.

Reduces Capex to $198 Million; Pre-Tax Internal Rate of Return (IRR) of 25.2%;

Average Annual Zinc Production of 46.9 Million lbs; Bottom Quartile Zinc Cash Costs

TORONTO, ONTARIO October 20, 2021 – Chieftain Metals Corp. (“Chieftain Metals”or the “Company”) (TSX: CFB) is pleased to announce the results of an independent, technical report (the “2014 Feasibility Update”) updating the Company’s 2012 feasibility study, prepared in accordance with NI 43-101, on the high-grade Tulsequah Chief polymetallic deposit located in north-western British Columbia as well as the nearby Big Bull deposit collectively referred to as Tulsequah Shazah Camp.

The 2014 Feasibility Update, prepared by a team led by JDS Energy & Mining Inc. (“JDS”), incorporates improvements to the Tulsequah Chief project including optimizing production configuration, operations, logistics and mill size, dramatically improving the financeability of the project. The 2014 Feasibility Update reflects a project with lower capital costs resulting in enhanced projected investment returns notwithstanding the lower annual production. Additionally, this operating profile preserves all the growth potential and is expected to allow Chieftain to flow funds for project expansion out of cash flow.

(all amounts in Canadian dollars unless stated otherwise)

Highlights of the 2014 Tulsequah Chief Feasibility Update (Table 1)

- Based on a 1,100 tonne per day underground mining operation with an 11-year mine life.

- Reserves of 4.4 M tonnes (of which 684 Ktonnes (15%) are proven) are the higher-grade portion of the 6.4 M tonnes previously reported in the 2012 Feasibility Study.

- Base Case metal price deck for metals and foreign exchange based on spot prices at October 15, 2014.

- Annual Zinc Production of 46.9 million pounds (lbs) at a C1 cash cost of zinc production (net of by-product credits) of negative ($0.25)/lb.*

- Use of conventional barging for five months of the year to transport concentrate and supplies. This logistical solution eliminates the road proposed in the 2012 Feasibility Study saving $125 million in capex.

- Pre-production capital costs are estimated to total $198 million including contingency.

- Operating costs are estimated to average $186 /tonne processed including concentrate shipment.

- The Feasibility Update yields a pre-tax Net Present Value (NPV8%) of $212 million and an IRR of 25.2% and post-tax NPV8% of $146 million and an IRR of 21.9%.

* C1 Cash cost of zinc production is calculated by taking the life of mine operating costs and the off-site costs to produce all metals, minus the revenue generated by all produced metals excluding zinc, divided by the total pounds of zinc produced.

Victor Wyprysky, President and CEO commented: “We are pleased to deliver a feasibility optimization demonstrating strong economics for Tulsequah. The NPV8% of $212 million represents a pre-tax Net Asset Value of approximately $12.65 per share pre-financing based on the current outstanding shares and average annual EBITDA at full production of $69 million or $4.09 per share pre-financing based on the current outstanding shares. The lower tonnage design enables a much lower capex than first envisioned in 2012 without a significant decrease in operating cash flow due to the high-grade focus of the new mine plan. Given the market’s current preference for smaller capital projects, this feasibility update is expected to allow Chieftain to finalize project financing and plan construction start-up.”

Table 1. Highlights of the Tulsequah Chief Feasibility Update

| Reserves | Payable Metal | Pricing1 | |

|---|---|---|---|

| Proven and Probable Reserve | 4.43 Mt | ||

| Au | |||

| Ag | 2.85 g/t | 356 k oz | US$ 1238/oz |

| Zn | 104 g/t | 10,956 k oz | US$ 17.00/oz |

| Cu | 6.95% | 519.5 M lbs | US$ 1.06/lb |

| Pb | 1.46% | 120.9 M lbs | US$ 3.08/lb |

| Exchange Rate | 1.29% | 77.7 M lbs | US$ 0.93/lb |

| USD:CAD 0.89 | |||

| Project Highlights | |||

| Mining rate | 1,100 t/d | Net Smelter Return (NSR) | $ 358 /t |

| Mine life | 11 years | ||

| Pre-production Capex | $ 198 M | Operating cost | |

| Sustaining Capex | $ 84 M | • Site | |

| Closure Costs net of Salvage Value | $ 3.8 M | • Ocean transport | $ 160 /t |

| Total | $ 26 /t | ||

| Margin | $ 186 /t | ||

| $ 172 /t | |||

| Economic Results | Pre-Tax | Post-Tax | |

| Undiscounted Net Cash Flow | $ 481.8 M | $ 345.2 M | |

| NPV (8%) | $ 212.0 M | $ 145.9 M | |

| IRR | 25.20% | 21.90% | |

| Payback period | 3.8 years | 3.9 years | |

1Spot prices October 15, 2014.

Resources and Reserves

The mineral resource estimate (Table 2) was updated and classified using the Canadian Institute of Mining and Metallurgy (“CIM”) definitions referred to in National Instrument 43-101 into Measured, Indicated, and Inferred Mineral Resources. The mineral resource estimate was developed using industry-accepted methods with GEMS software in blocks sized 5 m x 5 m x 4 m. For the purpose of resource estimation, all assay intervals within the mineralized units were composited to two metres and grades were capped prior to estimation. Zinc was capped at 30%, lead and copper at 10%, gold at 25 g/t and silver at 600 g/t for the resource estimate.

The reserve estimate is summarized in Table 3 below. The proven and probable reserve totals 4.435 Mt of minable material at a dilution rate of 17.6% and mining recovery of 95%. Opportunity exists to refine the stope designs to reduce the dilution to an acceptable industry standard 15%.

Table 2. Tulsequah Chief and Big Bull Mineral Resources (Inclusive of Mineral Reserves) as ofOctober, 2014

Tulsequah Chief

| Category | M Tonnes | Cu (%) | Pb (%) | Zn (%) | Au (g/t) | Ag (g/t) | Zn Eq (%) |

|---|---|---|---|---|---|---|---|

| Measured | 0.787 | 1.57 | 1.50 | 8.60 | 2.81 | 105.5 | 30.9 |

| Indicated | 5.136 | 1.43 | 1.28 | 6.76 | 2.80 | 102.1 | 28.1 |

| Total M+I | 5.923 | 1.45 | 1.31 | 7.00 | 2.80 | 102.5 | 28.5 |

| Inferred | 0.439 | 0.79 | 1.03 | 5.54 | 2.33 | 80.6 | 21.6 |

Big Bull

| Category | M Tonnes | Cu (%) | Pb (%) | Zn (%) | Au (g/t) | Ag (g/t) | Zn Eq (%) |

|---|---|---|---|---|---|---|---|

| Indicated | 0.653 | 0.34 | 1.54 | 4.11 | 3.03 | 125.0 | 23.8 |

| Inferred | 1.453 | 0.37 | 1.37 | 4.15 | 2.67 | 103.9 | 21.4 |

Total Combined Tulsequah Chief and Big Bull

| Category | M Tonnes | Cu (%) | Pb (%) | Zn (%) | Au (g/t) | Ag (g/t) | Zn Eq (%) |

|---|---|---|---|---|---|---|---|

| Measured | 0.787 | 1.57 | 1.50 | 8.60 | 2.81 | 105.5 | 30.9 |

| Indicated | 5.789 | 1.31 | 1.38 | 6.46 | 2.83 | 104.7 | 27.6 |

| Total M+I | 6.576 | 1.34 | 1.33 | 6.71 | 2.82 | 104.8 | 28.0 |

| Inferred | 1.892 | 0.47 | 1.29 | 4.47 | 2.59 | 98.5 | 21.5 |

- $100/tonne Net Smelter Return (NSR) cut-off used

- The cut-off value is based on a price of US$ 1,250.00 per ounce of gold, US$ 19.00 per ounce for silver, US$ 0.90 per pound for zinc and lead and US$ 2.75 for copper and recoveries of 90.0 % for gold, 84.5 % for silver, 89.0 % for copper, 66.2% for lead and 89.0 % for zinc.

- Resource: Zn EQ% = ((Au g/t*36.69x)+ (Ag g/t*0.5013)+ (Cu %*36.24)+ (Pb %*9.39)+ (Zn %*10.2))/10.2

- Qualified Person for resource estimate is Dr. Gilles Arseneau, P.Geo, of SRK Consulting (Canada) Inc.

- The Resources are inclusive of the Mineral Reserves stated in Table 3.

Table 3. Tulsequah Chief Mineral Reserves

| Category | M Tonnes | Cu (%) | Pb (%) | Zn (%) | Au (g/t) | Ag (g/t) | Zn Eq (%) |

|---|---|---|---|---|---|---|---|

| Proven | 0.684 | 1.48 | 1.36 | 7.84 | 2.71 | 101 | 29.4 |

| Probable | 3.751 | 1.45 | 1.28 | 6.78 | 2.88 | 104 | 28.9 |

| Total P + P | 4.435 | 1.46 | 1.29 | 6.95 | 2.85 | 104 | 29.0 |

- Mineral reserves are reported based on underground mining above a US$ 200/tonne NSR cut-off value.

- Cut-off grades are based on a price of US$ 1,250 per ounce of gold, US$ 19.00 per ounce for silver, US$ 0.90 per pound for zinc and lead and US$ 2.75 for copper and recoveries of 90.0 % for gold, 84.5 % for silver, 87.8 % for copper, 65.1 % for lead and 89.3 % for zinc.

- Reserve: Zn EQ% = ((Au g/t*36.64x)+ (Ag g/t*0.4991)+ (Cu %*36.73)+ (Pb %*8.81)+ (Zn %*10.04))/10.04

- Qualified person for the reserve estimate is Mike Makarenko, P.Eng, JDS Energy & Mining Inc

The Underground Mine

A new underground mine, adjacent to and beneath old workings that were previously operated by Cominco Ltd. from 1951-57, is planned to be developed through the existing 5200 and 5400 Level adits and would be used as the primary access to the mine for all personnel, mine services, equipment and supplies.

In the 2014 Feasibility Update, the new mine is proposed to operate as a ramp-entry truck haulage operation via a spiral ramp that will be developed to a vertical depth of 570 metres with mining levels located at 30-metre vertical intervals. Transverse and longitudinal sub-level stoping would be the primary mining methods with a minor amount of mechanized cut-and-fill stoping. Paste backfill and unconsolidated loose waste rock are planned to be used for replacement of mined voids for both methods. Additional cement would be added to the paste backfill for strength where future mining would be adjacent to exposed backfill.

Metallurgy

The 2014 Feasibility Update contemplates the design of a process plant for the Tulsequah Chief project to process massive sulphide mineralization at a nominal rate of 1,100 t/d. This process rate would result in the appropriate amount of concentrate for the barging plan as described in the 2014 Feasibility Update. The process facility is planned to consist of a primary crushing plant, mill feed storage bin and conveyor corridors located underground, grinding, flotation and filtration, effluent treatment plant, part of which was constructed in 2011, and backfill plant. The process plant operation is scheduled to operate two shifts per day and 365 days per year with an overall availability of 90%. The process plant is designed to produce copper, lead and zinc concentrates and gold-silver doré as outlined in the following table of the predicted metallurgical response.

Table 4. Predicted Metallurgical Response

| Product | Wt (t) | Concentrate Assay Estimates | Recovery Estimates (%) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Cu % | Pb % | Zn % | Ag g/t | Au g/t | Cu | Pb | Zn | Ag | Au | ||

| Copper Conc | 6.2 | 21 | 2.8 | 5.1 | 1300 | 22 | 89 | 13 | 4.5 | 78 | 47 |

| Lead Conc | 1.4 | 0.3 | 60 | 7.1 | 467 | 5.6 | 0.3 | 65 | 1.4 | 6.3 | 2.8 |

| Zinc Conc | 10.4 | 0.7 | 0.4 | 60 | 80 | 0.8 | 5.0 | 3.4 | 90 | 8.0 | 2.9 |

| Pyrite Conc | 33.0 | 0.2 | 0.3 | 0.6 | 22 | 0.3 | 3.6 | 8.5 | 2.9 | 6.9 | 3.6 |

| Tailings | 48.8 | 0.1 | 0.2 | 0.1 | 1.6 | 0.2 | 2.0 | 9.0 | 1.0 | 0.8 | 2.7 |

| Feed | 100.0 | 1.46 | 1.29 | 6.95 | 103.72 | 2.85 | 100 | 100 | 100 | 100 | 100 |

| Gravity Concentrate | 0.2 | 224 | 522 | 0.1 | 0.5 | 0.1 | 0.5 | 41.0 | |||

Content of Arsenic and Antimony in the copper concentrate is anticipated to average 1.14% and 0.34% respectively.

Access and Transportation

Concentrate produced during operations are planned to be barged, in containerized bags, along the Taku River to a transfer barge at the mouth of the river and then on to the port of Seattle to be shipped to Asia. Operating supplies are planned to be barged to site in containers and stored at Paddy’s Flats, 12 km south of the mine. The proposed barging will occur for approximately five months of the year. Cominco used barging during its operations in the 1950’s. Improvements to the barge landing area at site are planned to protect the shore, provide for two barging berths and storage and transfer of Chieftain’s concentrates to the barges and offloading of supplies. The 128 km road from Atlin, BC, to the Tulsequah Chief Mine site described in the 2012 Feasibility Study is no longer contemplated as the logistical solution for shipping concentrate to market.

An existing all-season gravel road, constructed in 2007 – 2008, connects the different working areas on site. Bagged concentrate and supplies are planned to be transported by tractor-trailer and flat-deck truck to the storage area.

A 1,050 m long airstrip exists 2 km north of the mine near Shazah Creek.

Infrastructure

All surface buildings are planned to be laid out and located in close proximity to the mine, including the mineral process building, an administration building, which includes first aid, fire truck and ambulance, a diesel-generated power plant, maintenance/warehouse facility for surface equipment and an existing effluent treatment plant. Bulk diesel is proposed to be stored in two x 5 million litre tanks located within a lined spill containment area at Paddy’s Flats. A 160-person camp and kitchen/dining facility has been designed to complement the existing 50 person camp located at the Shazah airstrip. The mine dry is planned to be located near the camp.

A 1.7 Mt capacity tailings facility is designed to be constructed approximately 5 km north of the mine in the valley of Shazah Creek. De-pyritized tailings with limestone added is proposed to be transported in the form of a dense slurry by pipe. The ultimate dam height will be 9 meters and is designed to have an emergency spillway for unexpected flood events, a toe berm to ensure stability and a liner to prevent seepage. Seismic stability is ensured with a shallow, overall designed dam slope of 5 horizontal to 1 vertical. The dam is scheduled to be constructed in 2 phases, with a small starter dam in pre-production and the second phase, ultimate dam in year 2 of operations. Surplus water would be treated and discharged to prevent the accumulation of surplus water in the impoundment.

Potentially acid generating (PAG) waste rock and pyrite concentrate is planned to be temporarily stored in separate lined impoundments 1 km south of the mine. PAG waste rock and pyrite concentrate would be re-handled into the mine as backfill during the mine life. These materials would be stored subaqueous to minimize the potential for acid generation.

The capacity of the existing effluent treatment plant is designed to be increased by adding a second phase designed to process additional water from the underground mine, tailings reclaim and mill process.

It is proposed that personnel will work on various rotating schedules, including eight days on/six days off, two weeks on/two weeks off, and four weeks on/two week off. The work schedules are required to cover the different tasks on site.

Capital Costs

The initial capital requirement for the Project is estimated to be $198.0 M, as detailed in Table 5.

Table 5. Pre-production Capital Costs

| Items | Estimate (M$) |

|---|---|

| Site Development | 3.8 |

| Underground Mining | 18.4 |

| Underground Infrastructure | 10.5 |

| Processing Plant | 44.6 |

| Tailings & Waste Rock Management | 6.6 |

| On-Site Infrastructure | 33.9 |

| Project Indirects | 15.2 |

| Engineering & EPCM | 13.5 |

| Owner’s Costs | 21.4 |

| Pre-Production OPEX | 11.7 |

| Subtotal Pre-Production Capital | 179.6 |

| Contingency (11.4%) | 18.4 |

| Total Pre-Production Capital | 198.0 |

The Project has a total sustaining capital requirement of $84.0 million which includes extension of the main ramp to depth, mobile equipment, mobile equipment rebuilds and replacements, tailings dam raise, completion of phase 2 of the effluent treatment plant, capital improvements and closure costs net of salvage value.

An independent review of previous construction on site calculated that Chieftain is benefiting from over $107 million worth of physical work completed on site from 2007 to 2012 including the barge landing, airstrip, construction camp, 23 km of onsite roads, shops and effluent treatment plant.

Reclamation/Closure & Salvage Costs

Total reclamation/closure and salvage costs have been estimated as follows:

Table 6. Reclamation/Closure & Salvage Costs

| Items | M$ |

|---|---|

| Reclamation/Closure | 8.1 |

| Salvage Value | 4.4 |

Operating Costs

Total operating costs for the Project have been estimated as follows:

Table 7. Operating Costs

| Items | $/tonne |

|---|---|

| Mining | 29.35 |

| Processing | 31.08 |

| Power | 36.07 |

| G&A; | 29.85 |

| Transportation (Conc. and supplies) | 59.74 |

| Total | 186.09 |

This cost estimate represents the Life of Mine Cash Cost of the Project, from years 1 – 11 inclusive.

The C1 Cash Operating Costs net of by-product credits based on October 15, 2021 spot prices and on a co-product basis are as follows:

| Metal | Unit | Annual Prod. | Cash Cost* | Co Product Prod. Cost |

|---|---|---|---|---|

| Zinc | lbs | 46.9 million | – $0.25 | $0.38 |

| Copper | lbs | 10.9 million | -$2.54 | $1.06 |

| Gold | oz | 32,100 | -$753.67 | $574.31 |

* C1 Cash cost of zinc production is calculated by taking the life of mine operating costs and the off-site costs to produce all metals, minus the revenue generated by all produced metals excluding zinc, divided by the total pounds of zinc produced.

Note: All silver and lead are accounted for in by-products

Financial Analysis and Sensitivities

Using spot prices at October 15, 2014, the study yields a pre-tax NPV8% of $212.0 million and an IRR of 25.2% with a payback period of 3.8 years and a post-tax NPV8% of $145.9 million and an IRR of 21.9% with a payback period of 3.9 years.

Sensitivity tables for changes in capital costs, operating costs, metal prices, and discount rates are shown below. The Project’s NPV is most sensitive to grade, metal prices, followed by operating costs, and least sensitive to capital costs.

Table 8. Project Economics Sensitivity

| Pre-tax NPV8.0% ($M) | Average Full Production Year Operating Cash Flow ($M) | |||||

|---|---|---|---|---|---|---|

| -10% | 0% | 10% | -10% | 0% | 10% | |

| Capital Cost | 236.8 | 212.0 | 187.2 | 68.6 | 68.6 | 68.6 |

| Operating Cost | 255.0 | 212.0 | 168.9 | 74.9 | 68.6 | 62.3 |

| Metal Prices | 112.0 | 212.0 | 311.9 | 53.0 | 68.6 | 84.2 |

Table 9. Project NPV Sensitivity to Discount Rate

| Discount Rate | Pre-tax NPV ($M) | After-tax NPV ($M) |

|---|---|---|

| 0% | 481.8 | 345.2 |

| 5% | 290.7 | 204.8 |

| 8% | 212.0 | 145.9 |

| 10% | 169.9 | 114.1 |

| 12% | 134.4 | 87.0 |

Project Schedule

Project construction is expected to commence in the Spring of 2015, subject to project financing. Site and plant earthworks and civil construction are expected to begin in late Q1 2015, mill and plant construction in Q3 2015, and tailings construction in Q2 2016, with commissioning and production beginning in Q4 2016. Underground development is planned to begin in Q1, 2016.

Environment and Permitting

The Tulsequah Chief project was deemed substantially started by the British Columbia (BC) Minister of Environment in June 2012. After a judicial review, it was decided that the Minister must consult with the Taku River Tlingit First Nation on the substantially started decision and render a new decision after the end of the consultation period, on November 2, 2014.

The Company has all necessary permits to begin construction on site including a Mines Act permit from the BC Ministry of Energy and Mines that permits the start of construction on site. A Mines Act permit amendment will be applied for once further engineering is completed on the tailings dam, surface plant facility and underground mine.

This project design contemplates the necessary fixes to the effluent treatment plant such that the design deficiencies of the plant will be addressed at the start of the project build.

The mine plan would address the environmental legacy and provide the long-term solution to the acid drainage at the project site. The old workings, mined by Cominco in the 1950’s, will be filled with the de-pyritized tailings and cement to prevent the water from coming into contact with the sulphides and turning acidic. The closure plan contemplates site monitoring of site for 10 years post closure.

Pursuant to a condition under amendment #3 of the BC Environmental Assessment Certificate, which contemplates barging, an environmental oversight committee would be created prior to the start of construction and would consist of representatives from the BC Ministry of Environment, Taku River Tlingit First Nation, US Department of Interior and Chieftain.

Chieftain will work with authorities to stay within the parameters of the current BC Environmental Assessment Certificate or determine if any amendment is required due to reduction of production level or conventional barging even though air-cushion barging is fully permitted. Chieftain is not required to obtain permits to conduct conventional barging of containerized concentrate in Alaska when using a third party contractor that has the required permits and authorizations.

Exploration

In the press release of November 20th, 2013, Chieftain announced exploration results that confirmed the existence of potential new resources near the Tulsequah Chief mine that could significantly extend the life of the operation. This provided another solid reason to explore several newly modelled 3D-Induced Polarization (“3D-IP”) geophysical inversion targets identified adjacent to the known Big Bull and Tulsequah Chief mineral resources, as well as the prospective ‘Sparling-Banker’, high-grade Au-Ag-Cu-Zn-Pb-rich volcanogenic massive sulphide mineral showings.

Technical Report

A NI 43-101 Technical Report will be filed within 45 days on SEDAR and will be available at that time on the corporate website.

Qualified Persons

Keith Boyle, P. Eng., Chief Operating Officer of Chieftain Metals Corp. and qualified person under NI 43-101 has supervised the preparation, reviewed and approved the scientific and technical content of this news release.

The Feasibility Study was conducted under the overall review of Gordon Doerksen, P. Eng. of JDS Energy and Mining Inc. of Vancouver, British Columbia, and serves as Principal Author of the Technical Report.

The following Independent Qualified Persons have assumed authorship of this report:

Gordon Doerksen

Michael Makarenko

Scot Klingmann

Frank Palkovits

Gilles Arseneau

Robert Marsland

David West

Harvey McLeod

Kelly McLeod

Nadia Krys

P. Eng., Project Director, JDS Energy & Mining Inc.

P. Eng., Sr. Project Manager, JDS Energy & Mining Inc.

P. Eng., Mining Engineer, JDS Energy & Mining Inc.

P. Eng., Principal, Kovit Engineering

Ph.D., P. Geo. Associate Consultant, SRK Consulting (Canada) Inc.

P. Eng., Senior Environmental Engineer, Marsland Environmental Associates

P. Eng., David West Consulting

P. Eng., P.Geo., Klohn Crippen Berger

P.Eng., Metallurgical Engineer, JDS Energy & Mining Inc.

P.Eng., Marine Lead/Study Manager, Ausenco Engineering Canada Inc.

About Chieftain Metals

Chieftain Metals Corp. is a public holding company, whose principal business is the acquisition, exploration and development of mineral properties. The Company’s business has focused on the development of the shovel ready, high-grade Tulsequah deposit located in north-western British Columbia, Canada. Chieftain’s properties consist of 60 mineral claims and Crown-grants covering approximately 32,453 hectares and cover two previously producing mines.

Forward-Looking Information:

This news release contains forward-looking statements. All statements, other than statements of historical fact, are forward-looking statements and can be identified by the use of future-oriented words and phrases including without limitation “may”, “will”, “could”, “subject to”, “expects” and similar words and their negative variations thereof. Forward-looking statements in this press release are based on the beliefs, estimate and opinions of the Company’s management on the date the statements are made and address activities, events or developments that the Company expects or anticipates will or may occur in the future and are based on current expectations and assumptions. Forward-looking statements involve a number of risks and uncertainties both known and unknown. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements contained in this news release include, without limitation, statements regarding the Company’s expectation of the projected timing and outcome of the development of the Tulsequah chief mine, statements regarding the Company’s expectations regarding the receipt of all required amendments to permits and approvals required to implement the mine plan at Tulsequah; mineral resource and mineral reserve estimates; operating and capital cost estimates; estimates of mineral grades and recovery rates; expectations regarding cash flow anticipated to be generated by the property; and other statements that are not historical fact.

Although management of the Company believes that its expectations are based on reasonable assumptions, it can give no assurance that these expectations will prove to be correct. Material assumptions regarding the forward looking statements contained herein include without limitation the key assumptions of the 2014 Feasibility Update which will be filed on SEDAR within 45 days of this news release. Important factors that could cause actual results to differ materially from those contained in the forward-looking statements used herein include, among others, risks relating to the Company’s exploration and property advancement efforts; fluctuations in metals prices; the inherently hazardous nature of mining-related activities; uncertainties concerning reserve and resources estimates; availability of outside contractors and financing in connection with the Company’s projects; uncertainties relating to obtaining necessary approvals and permits from governmental regulatory authorities; the possibility that environmental laws and regulations will change over time and become more restrictive; and availability and timing of capital for financing the Company’s exploration and development activities, including uncertainty of being able to raise capital on favourable terms or at all as well as those factors discussed in the Company’s latest annual information form for the year ended December 31, 2013. The Company does not intend to publicly update any forward-looking statements, whether as a result of new information or otherwise, except as may be required under applicable securities laws.